URGENT NEWS | For IQD Investors: The Iraq Shares Why Integration with the West is Difficult

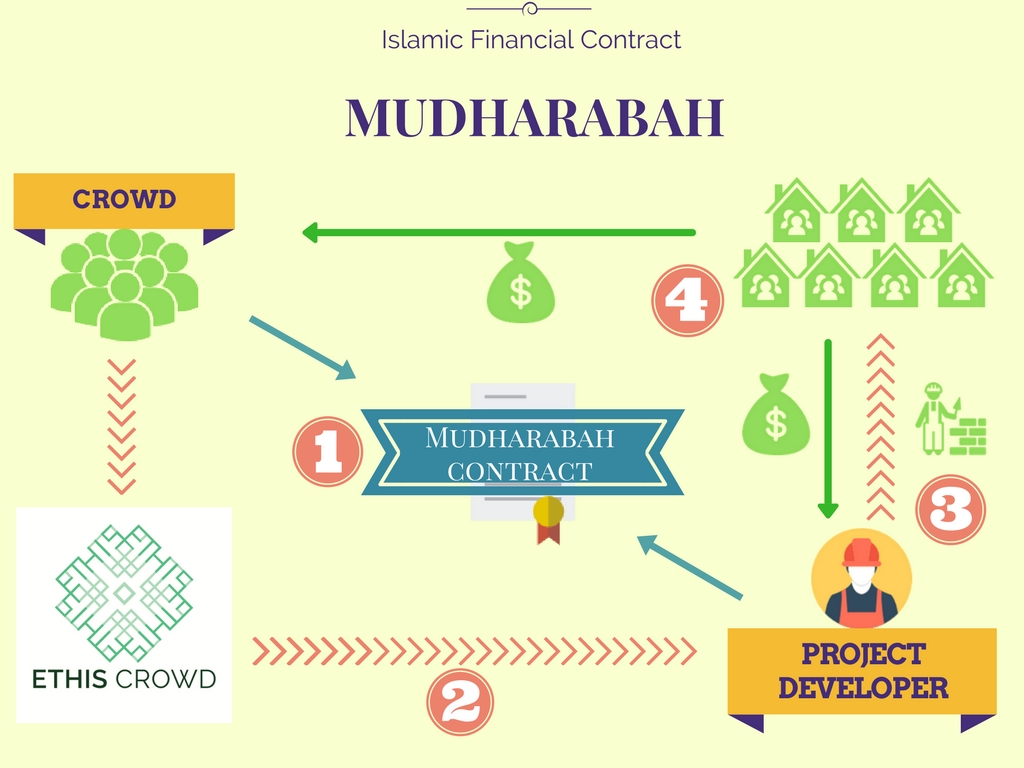

What Is Mudharabah?

- Mu (like "moo")

- da (like "dah")

- ra (like "rah," stressed syllable)

- bah (like "bah")

Mudharabah is a profit-sharing partnership between two parties:

Rab-ul-Mal – the investor (provides the money)

Mudarib – the entrepreneur or manager (provides the work and expertise)

How it works

Profits are shared according to a pre-agreed ratio (for example, 60% investor / 40% manager).

Losses are borne by the investor only, unless the manager was negligent or dishonest.

The manager loses their time and effort, but not money.

The key idea: both parties share risk and reward.

This model is commonly used in Islamic banking, investment funds, and trade finance.

Why Do Some Muslims Disagree with Earning Interest?

Many Muslims object to earning interest because of a concept called riba.

What is Riba?

Riba refers to guaranteed interest on money, regardless of outcome.

In Islam:

Money itself should not create money without effort or risk.

Wealth should be generated through real economic activity (trade, services, investment).

Why interest is seen as problematic

From the Islamic perspective, interest:

Guarantees profit without risk

The lender earns money even if the borrower loses everything.Shifts all risk to the borrower

This is viewed as unfair and exploitative.Encourages debt-based systems

Which can trap individuals and nations in long-term financial hardship.

Mudharabah vs. Interest (Simple Comparison)

| Interest-Based Loan | Mudharabah Partnership |

|---|---|

| Fixed, guaranteed return | Variable, shared profit |

| Lender takes no risk | Investor shares risk |

| Borrower bears losses | Loss shared (investor loses capital) |

| Money makes money | Money + effort create value |

Why Not All Muslims Agree Completely

There is debate within the Muslim world:

Some scholars say all interest is riba, no exceptions.

Others argue that modern banking interest is different from ancient exploitative lending.

Some Muslims allow interest in necessity situations, especially where Islamic alternatives don’t exist.

So, while Mudharabah is widely accepted, views on interest can vary by:

Scholar

Country

Financial system

Personal interpretation

In Plain English

Mudharabah = ethical investing based on shared risk and shared reward

Interest = money earning money with no risk, which many Muslims believe is unjust

The disagreement isn’t about wealth—it’s about how wealth is created

How Islamic Banks Work in Real Life

Islamic banks do not lend money for interest.

Instead, they participate in real economic activity.

Think of an Islamic bank as a business partner, not a traditional lender.

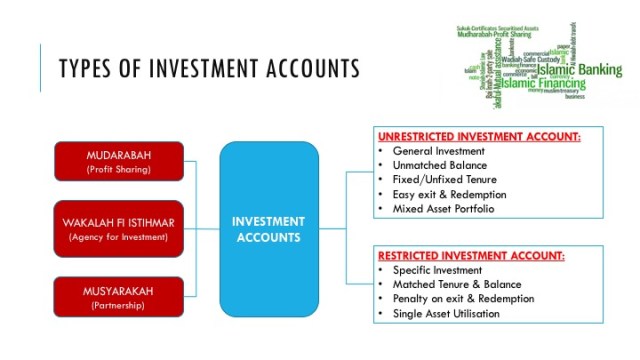

1. Savings Accounts (Mudharabah in Action)

When you deposit money in an Islamic bank:

You are the investor

The bank is the manager

Your money is invested in real businesses (trade, housing, infrastructure)

Profits are shared

Returns go up or down based on performance

No guaranteed interest rate

Some months you earn more, some less.

2. Home Financing (Murabaha – The Most Common)

Instead of lending you money to buy a house:

The bank buys the house

The bank sells it to you at a marked-up price

You pay in fixed monthly installments

Key difference:

That markup is not interest

It’s a sale price agreed in advance

You know the total cost from day one.

3. Business Financing (Mudharabah or Musharakah)

For entrepreneurs:

The bank invests in the business

Profits are shared

Losses are shared (bank loses money if the business fails)

The bank cares if the business succeeds—because it’s taking risk with you.

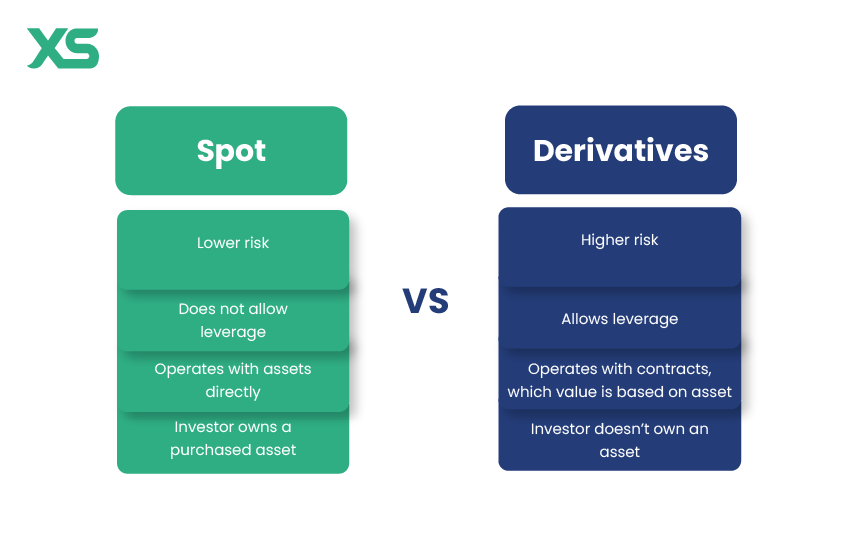

4. No Speculation, No Gambling

Islamic banks avoid:

Derivatives

Excessive leverage

Gambling-like speculation

Investing in alcohol, weapons, or exploitative industries

Everything must be tied to real assets or services.

Now Compare This to Western Investing

Western finance is built around interest and debt.

How Western Banks Operate

You deposit money

The bank lends it out at interest

Borrowers must pay even if they fail

The bank gets paid first, no matter what

Profit is guaranteed for the lender; risk is mostly on the borrower.

Western Investing (Stocks, Bonds, Funds)

There is risk sharing in markets:

Stocks = shared risk and reward

Bonds = fixed interest, low risk

Derivatives = high risk, often speculative

Western systems mix risk-sharing and risk-shifting.

Side-by-Side: Easy Comparison

| Islamic Banking | Western Banking |

|---|---|

| Profit-sharing | Interest-based |

| Risk shared | Risk pushed to borrower |

| Asset-backed | Often debt-based |

| No guaranteed return | Guaranteed lender return |

| Long-term stability focus | Short-term profit focus |

Why This Matters in the Real World

Islamic finance aims to:

Reduce debt bubbles

Discourage reckless lending

Keep money tied to real economic value

Promote fairness between investor and borrower

Western finance aims to:

Maximize liquidity

Scale fast

Reward capital efficiency

Accept higher systemic risk

Neither system is “perfect”—they’re built on different values.

Simple Takeaway

Islamic banks invest with you

Western banks lend to you

One shares risk

The other sells risk

That’s the core difference.

.