Iraq Turkey Pipeline Dispute is Affecting Oil Prices Globally; Details Timeline and Latest Development

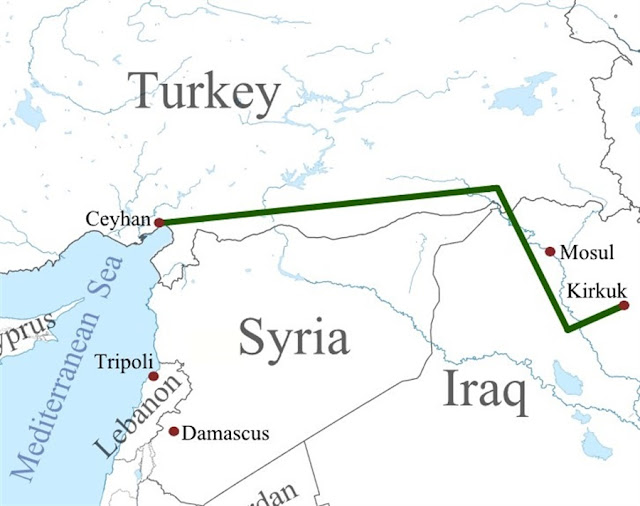

Negotiations between Iraq and Turkey concerning the oil pipeline continue to be difficult. High-level diplomacy has been unsuccessful in overcoming the hurdles, while Turkey has filed a legal claim for $950 million in damages in September of 2023. The pipeline connecting Kirkuk and Ceyhan has remained shut since 2023, with little sign of an imminent reopening for the export of oil from northern Iraq to Turkey.

Turkey has cut off the oil supply through the Iraq-Turkey pipeline for nearly six months after an extended nine-year legal battle that ended with a resolution from the International Chamber of Commerce (ICC). There were speculations that President Erdogan would arrange a major diplomatic trip to Baghdad this month to address restarting the pipeline. However, no such talk has been made public. This issue is becoming increasingly critical as millions of barrels of oil sit stationary in ports; Foreign Minister Hakan Fidan recently visited Baghdad but did not discuss the blockade.

The court of arbitration in Paris has declared Turkey in breach of the 50-year-old pipeline transit agreement and awarded Iraq with $1.5 billion in compensation. In response, Turkey has blocked half a million barrels per day from the KRG in northern Iraq that were headed to be shipped out through Ceyhan port. This action has created a great deal of reverberations among oil companies both regionally and worldwide.

Erdogan has accused Iraq and the KRG of internal squabbling, but officials from both deny it and attribute the interruption to Turkey instead. Although Turkey initially said it was simply abiding by ICC regulations, it quickly became evident that they were attempting to settle a $1.5 billion compensation claim and resolve a second legal dispute regarding oil flows since 2018. So far, there has yet to be any indication that Turkey will return to pumping crude anytime soon.

Turkey's blocking Iraq's oil exports and attempting to comply with its requests has created insecurity along an essential global and regional economic stability pipeline. This channel was delivering around 10% of Iraqi exports, which is 0.5% of world production, with Iraq being the second-biggest producer of OPEC. The suspension of these exports resulted in a jump of above $70 a barrel in global oil prices. Additionally, revenues from oil exports constitute 80% of the Kurdistan Regional Government’s annual budget, making its future highly uncertain.

As the blockage has continued, choking global crude supply, it has contributed to increasing oil prices, especially affecting the European Union, which has dramatically increased its imports of Iraqi oil to replace Russian gas. As an example, the KRG-controlled northern Iraqi fields supply more than half of Italy's crude oil needs. Europe is in a precarious position with no quick and easy solution since the KRG oil flow has been cut off.

It's not just Europe that's suffering.

A prolonged embargo, which has already cost the KRG more than $2 billion, could decimate northern Iraq's economy and potentially result in the collapse of the semi-autonomous KRG. The Iraqi federal government has cut the KRG's budget for years. The unresolved situation may cause a disruptive wave of migration; tens of thousands of Iraqi Kurds have already migrated to Europe, and more may do so soon.

The financial consequences of the oil export crisis have led to large deficits for both the KRG and Baghdad, which could create catastrophic instability in Iraq. This would offer militant groups like the Islamic State a major opportunity to catalyze further destabilization. The KRG's institutions are suffering greatly, leaving the country even more vulnerable as KRG security forces are likely to move resources away from defending their detention centers so they can focus on addressing other issues.

While Erbil, the regional capital of the KRG, and Baghdad reached an agreement in April, encouraging hopes that Turkey would resume exports after its May elections, there are no signs of meaningful progress from Ankara.

The potential damage is great: U.S. investments in Iraq are at risk of collapse, and the economic health of the federal government hangs in the balance while Russia and Iran look to take advantage of the precarious situation. The conflict has already led to international oil companies cutting investment by $400 million as well as layoffs for hundreds of employees, while more legal action against governments involved looms. Furthermore, if unresolved for much longer, Iraq's credibility among investors will suffer greatly.

The biggest worry is what could arise if Erbil keeps losing billions of dollars in oil income because of the pipeline feud. Some of its crude may be smuggled out through Iran, and Turkey might have to depend on Iranian and Russian oil for their needs. This could spell disaster for the KRG, whose survival depends on these revenues; it may result in a bureaucratic battle between the two primary factions, the Patriotic Union of Kurdistan (PUK) and the Kurdistan Democratic Party (KDP), potentially escalating into a full-blown civil war.

Instability in Iraqi Kurdistan could also spread to wider Iraq, which is already teetering on sectarian conflict. Last year, Iran conducted attacks on alleged Iranian opposition groups in Iraqi Kurdistan, aggravating intra-Shiite political tensions. The fall of the KRG could create a vacuum that allows Iran to ramp up its involvement, further escalating simmering tensions and posing a threat of a country-wide civil war.

In 2012, Turkey strengthened bilateral relations with the KRG in order to influence the Syrian Kurds in post-Assad Syria. As Turkey became concerned about a growing Iranian presence in Iraq, it viewed its ties with the KRG as a tool of regional influence. Cultivating the KRG’s dependence on the Turkish oil pipeline route through Ceyhan made complete sense.

However, Baghdad's arbitration victory against Turkey over KRG oil exports threw a spanner in the works when it suddenly consolidated central Iraqi dominance over the exports, undermining Turkish influence in Iraqi Kurdistan. In an effort to thwart the KRG's aspirations for independence, Baghdad has taken this step. This may have influenced Turkey's view of the KRG.

Recent evidence of heightened contact between Iraqi Kurdistan politicians and the PKK, the separatist Kurdistan Workers’ Party fighting for independence in southeastern Turkey, has deteriorated Turkey's relationship with the KRG. The PKK is seen as a terrorist organization in Turkey that aims at ethnic separatism in the southeast. As a result of his recent visit to Baghdad, the Turkish foreign minister urged Iraq to declare the PKK a terrorist organization.

In this context, it may even be argued that Turkey may see the pipeline dispute as an opportunity to greatly weaken the only internationally recognized independent Kurdish entity in the region, quashing hopes for autonomy among its own Kurdish population—and even reclaiming former Ottoman territories in Iraq and Syria.

International concerns should be expressed. Not only could Erdogan be signaling a return to Turkish militarism, having dramatically stepped up its own anti-PKK operations inside Iraqi Kurdistan, but the ongoing dispute also raises questions regarding the effectiveness of international arbitration in resolving high-stakes geopolitical disputes by itself.

Increasing tensions between Iraq and Turkey make it increasingly obvious that international arbitration cannot replace careful diplomacy. At a time when the globe faces a multitude of complex crises that require delicate, collaborative solutions, it is crucial for the international community to realize that arbitration risks stoking the fires of international tension without the assistance of diplomatic efforts.

The U.S. government could prove instrumental here. In order to resolve the current conflict between Baghdad, Ankara, and the KRG, Washington would need to facilitate dialogue between all three and encourage the opposing sides to develop a comprehensive agreement regarding oil exports. Moreover, this process must involve discussions concerning water, trade, and infrastructure. The longer these talks remain unresolved, Baghdad will increasingly suffer from severe inaccuracies in their finances until any payments due are completely wiped out - making a mutual resolution essential for both parties involved. An external mediation being present in this situation is immensely important in ensuring that none of the three sides experience any losses in their respective interests.

During the past half a decade, Erdogan has envisioned Turkey playing a more prominent role in the wider region—from helping to secure grain shipments out of war-torn Ukraine to assisting the U.N.-backed government in Libya during the civil war—until Russia suspended the deal last month. While Iraq is still recovering from the trauma of two decades of war, bullish foreign policy can significantly threaten its fragile stability.

This impasse appears to have been caused by Turkey’s accelerated anti-Kurdish nationalism and its insistence on controlling KRG oil exports. Turkey is using the situation to force Baghdad and Erbil to capitulate to oil arbitrations, even if that means destroying the KRG’s economy. Iraq and the KRG, on the other hand, are eager to resume exports.

In order to move forward, Turkey must recognize that if the KRG falls, the resultant destabilization in Iraq will create far bigger problems, including opening the door to Iran, its historic rival.

To prevent potentially calamitous regional instability, swift, careful, and diplomatic intervention is necessary by the international community.

This article was curated from a number of different articles, summarized and edited by the Edu Matrix YT Channel.